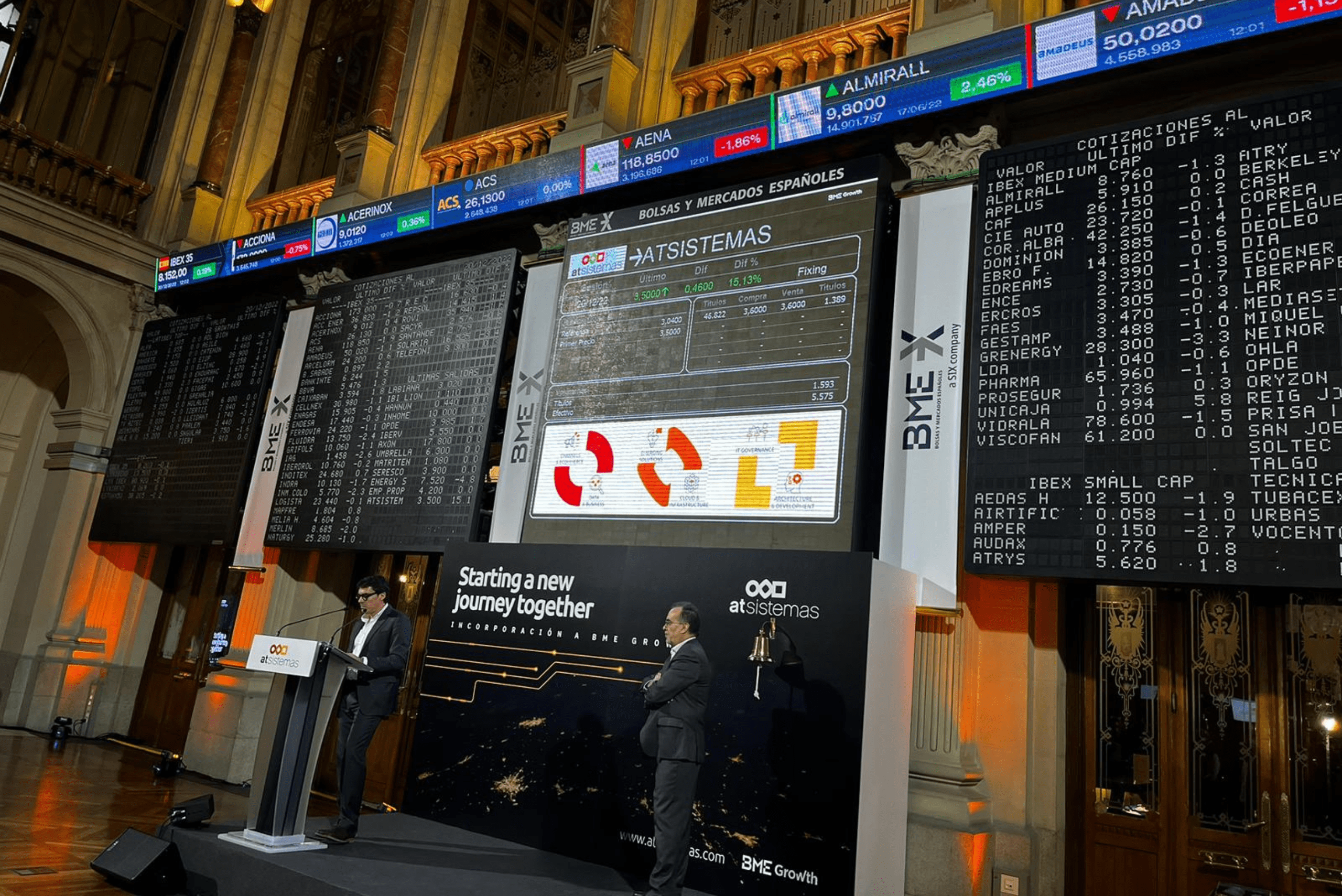

atSistemas joins the BME Growth market

atSistemas, a 100% Spanish digital services consultancy, announced its listing on the BME Growth market as part of its four-year strategic growth plan. atSistemas has priced its listing on the BME Growth market at 3.04€ per share which represents a total capitalisation of the group of 152€ million. The company has carried out a private placement of 715,857 shares among more than 500 minority investors, including mainly employees (who have had a preferential option and a discount on the share price).

With this addition to the market, the company seeks to continue driving its growth after having closed the acquisition of the Scottish consultancy firm specialising in Atlassian products, New Verve Consulting, in November 2022. The company closed its last fiscal year, corresponding to 2021, with a turnover of 97.3 million euros, 23% more than the previous year, while expanding to two new markets with the opening of offices in the United States and the United Kingdom, in addition to the creation of a development centre in Uruguay.

“Our incorporation in BME Growth, following a private placement among approximately 500 of our 2,200 employees, combines the objective of adding value as a company in the marketwith the infinite possibilities that this entails: providing our employees the opportunity to participate in the company’s capital. We are sure that this will generate extraordinarily positive synergies in both directions in the long term. Personally, after my 28 years in the company, 15 of them at the head of it, it has been a great satisfaction to see the response of our staff to the initiative even in extremely turbulent times in the markets.” says José Manuel Rufino Fernández, CEO of atSistemas.

For its entry into the market, the Spanish technology company has selected the BME Growth multilateral trading system to continue its growth and has also relied on Renta 4 Corporate and Cuatrecasas as registered advisor and legal advisor, respectively. This incorporation is part of a four-year strategic plan, 2021-2024, which includes more than 50 initiatives coordinated in a complete growth and transformation programme, with which it will tackle its clients’ most ambitious projects and lead the creation of professional opportunities for technological talent.

“There are several reasons that have brought us here, but mainly the operation has been designed to bring in employees and small investors. Currently, one of the biggest problems for companies in our sector is talent retention and we have had a great acceptance from our employees in the operation. The second reason for the exit is the great showcase offered by BME Growth in our positioning in other countries. I believe that the process we have gone through of transparency and viability of our company to get here, guarantees our customers and partners in the different countries where we are present, our technical and economic solvency” says Miguel Angel Sacristan Salvador, CSO of atSistemas.

“The incorporation of atSistemas further strengthens the digital and innovative character of BME Growth, a benchmark market for investors interested in small and medium-sized companies. Despite the complex context, 2022 has been a good year for BME Growth, with 15 debut companies and financing of 863 million euros for companies listed on the SME stock exchange” says Jesús González managing director of BME Growth.